Management Report

Selected chapters from the Bertelsmann Financial Statements 2019 can be found here in digital form.

The complete Annual Report 2019 can be found here as a PDF flip catalog.

Financial Year 2019

Financial Year 2019 in Review

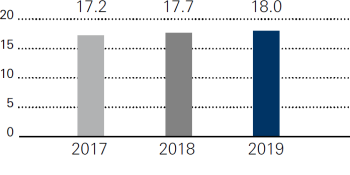

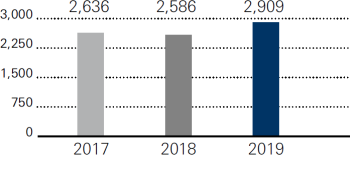

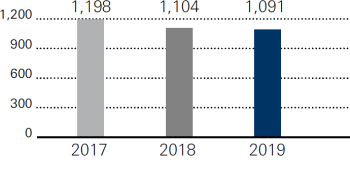

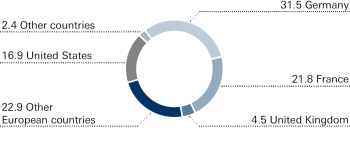

Bertelsmann reported successful business performance in the financial year 2019, with continued organic growth and high operating profit. Group revenues rose 2.0 percent to €18.0 billion (previous year: €17.7 billion), with organic growth of 1.2 percent. In addition to the book publishing business, the Group’s strategic growth platforms were the main contributors to this, especially Fremantle, Arvato Supply Chain Solutions, the digital businesses of RTL Group, BMG, Arvato Systems, and the digital businesses of Gruner + Jahr. Operating EBITDA increased to €2,909 million (previous year: €2,586 million). In addition to the positive business performance, the significant increase is also attributable to the initial application of the new IFRS 16 Leases financial reporting standard. As a result, the EBITDA margin rose to 16.1 percent (previous year: 14.6 percent). Group profit was once again high, at €1,091 million, compared with €1,104 million in the previous year. Bertelsmann anticipates positive business performance for 2020 as well.

- Revenue growth of 2.0 percent, continued organic growth of 1.2 percent

- Continued expansion of growth businesses with strong organic revenue growth

- Increase in operating EBITDA to €2,909 million, attributable in part to the new financial reporting standard, on a comparable basis above the high prior-year level

- EBITDA margin of 16.1 percent, compared to 14.6 percent during the same period last year

- Group profit exceeding the billion-euro mark for the fifth consecutive year

- Continued high profit contribution from fund activities of Bertelsmann Investments

Performance of the Group Divisions

RTL Group

RTL Group once again grew its revenues to a new record level in 2019, mainly driven by Fremantle’s expanding production business and the group’s digital businesses. Operating EBITDA also increased based on accounting method effects and Fremantle’s strong performance, despite higher costs for programming and streaming services. RTL Group rapidly expanded its streaming services in the European core markets. In Germany in particular, the group strengthened its market presence through alliances within and outside the Bertelsmann Group, primarily in the areas of advertising sales, technology and content.

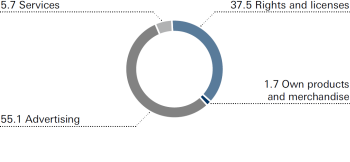

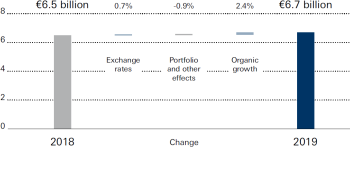

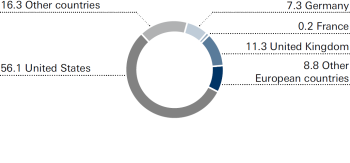

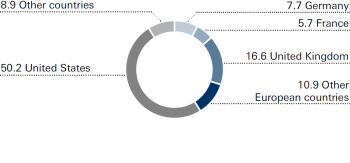

RTL Group’s revenues rose 2.2 percent to €6.7 billion (previous year: €6.5 billion), reaching a new peak. At €1.1 billion (previous year: €985 million), 16.1 percent (previous year: 15.1 percent) of total revenues were attributable to digital businesses such as digital advertising, streaming and advertising technology. Operating EBITDA increased by 2.7 percent to €1,439 million (previous year: €1,402 million), and the EBITDA margin was 21.6 percent (previous year: 21.5 percent).

At year-end, RTL Group had more than 1.44 million paying subscribers to its streaming platforms TV Now in Germany and Videoland in the Netherlands. This represents a 37 percent year-on-year increase. In France, approval was granted by the antitrust authorities to Salto, the joint streaming service of Groupe M6, TF1 and France Televisions, which is scheduled to launch in 2020.

Mediengruppe RTL Deutschland operated in a declining TV advertising market in 2019, but was able to partially compensate for lower advertising revenues with increased streaming and platform revenues. Earnings declined against a background of higher costs for sports content and the expansion of TV Now. The family of channels’ combined audience share increased to 28.1 percent (previous year: 27.5 percent) in the main target group. The market-leading flagship channel RTL Television did especially well, increasing its audience share for the first time since 2011.

In France, Groupe M6’s revenues fell slightly, while earnings remained stable. The decrease in revenue was mainly due to the sale of the soccer club Girondins de Bordeaux in 2018, which was almost completely compensated by higher TV ad sales following the acquisition of Lagardère’s TV operations in September 2019. With this acquisition, which included France’s leading children’s TV channel, Gulli, Groupe M6 further strengthened its market position and profitability. As a result, Groupe M6 increased its combined audience share in the key target group to 22.8 percent (previous year: 21.4 percent). At RTL Nederland, revenues and earnings declined despite a positive performance by the streaming business.

The production business Fremantle grew strongly: revenues and operating EBITDA increased at double-digit rates. This was driven by new seasons of successful series and show formats in the United States, as well as a thriving business at the German production subsidiary UFA.

RTL Group contributed to the Bertelsmann Content Alliance in Germany with numerous projects and expanded its group-wide audio business. The German Ad Alliance gained additional partners. In the field of advertising technology, the activities of the RTL Group subsidiaries Smartclip and SpotX were strategically realigned.

RTL Group created a leading European digital studio by combining Divimove and United Screens. The digital video network StyleHaul was discontinued in 2019.

Penguin Random House

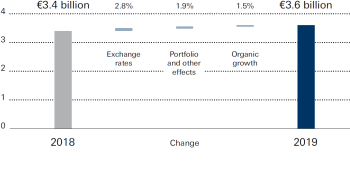

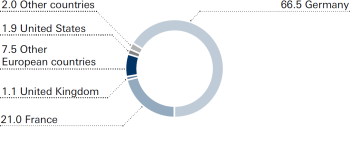

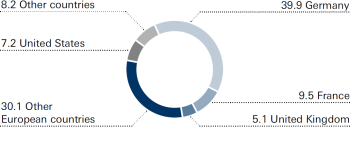

Penguin Random House saw significant growth in 2019 thanks to numerous bestsellers and market share gains in several markets. Including Germany’s Verlagsgruppe Random House, Penguin Random House increased its revenues by 6.2 percent to €3.6 billion (previous year: €3.4 billion). Operating EBITDA increased by 6.2 percent to €561 million (previous year: €528 million), also due to the initial application of the new IFRS 16 accounting standard. At 15.4 percent, the EBITDA margin once again reached a high level (previous year: 15.4 percent). In December, Bertelsmann announced its acquisition of full ownership of Penguin Random House.

Penguin Random House published the three biggest-selling adult titles of the year in the largest book market, the United States: “Where the Crawdads Sing” by Delia Owens sold over four million copies across all formats; Tara Westover’s autobiographical debut “Educated” and Michelle Obama’s “Becoming” each sold more than two million copies. Published in 46 languages, the memoir by the former US First Lady has sold 13 million copies worldwide since its November 2018 publication.

Audiobooks were a growth driver once again, with revenue increases in the double-digit percentiles in most markets. Penguin Random House strengthened its portfolio by acquiring several publishers, including the Little Tiger Group in the United Kingdom, a stake in the leading US independent publisher Sourcebooks, Ediciones Salamandra in Spain, and the global publishing rights for the prolific bestselling children’s author Eric Carle (“The Very Hungry Caterpillar”).

In the United States, Penguin Random House placed 496 titles on the “New York Times” bestseller lists, 61 at number one. Additional number-one bestselling titles for the group were “The Water Dancer” by Ta-Nehisi Coates, “The Testaments” by Margaret Atwood and “The Guardians” by John Grisham. Dr. Seuss’ children’s book classics sold more than 10 million copies.

Penguin Random House UK also had a very strong publishing performance, and revenue grew significantly. The publishers placed 43 percent of all the titles on the “Sunday Times” bestseller lists. Their top-selling titles included “Veg” by Jamie Oliver, “Becoming” by Michelle Obama and “The Testaments” by Margaret Atwood. The publishing group increased its market share, strengthened its international sales and expanded its audio business.

Penguin Random House Grupo Editorial improved its market position in the Spanish-speaking world with positively performing businesses and acquisitions; revenues showed strong growth. Its biggest bestsellers were “Sinceramente” by Cristina Fernández de Kirchner, “Sidi” by Arturo Pérez-Revert and “Largo Pétalo de Mar” by Isabel Allende.

Munich-based Verlagsgruppe Random House enhanced its market-leading position with a strong bestseller performance and rising backlist revenues. It placed 414 titles on the “Spiegel” bestseller lists, 23 of them at #1. The year’s top-selling titles were “Die Sonnenschwester” (“The Sun Sister”) by Lucinda Riley, “Der Ernährungskompass” (“The Diet Compass”) by Bas Kast and “Die Suche” by Charlotte Link.

Numerous Penguin Random House authors won prestigious awards, including Olga Tokarczuk, the Nobel Prize winner in Literature; Abhijit Banerjee and Esther Duflo, who were awarded the Nobel Prize in Economic Sciences; Saša Stanišić, who won the German Book Prize; and Margaret Atwood and Bernardine Evaristo, who together won the 2019 Booker Prize.

Gruner + Jahr

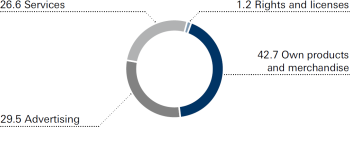

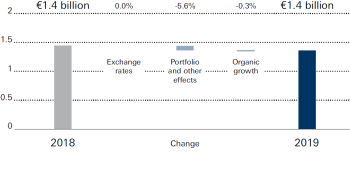

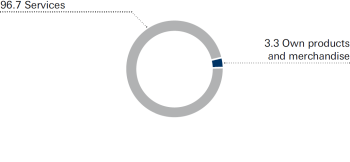

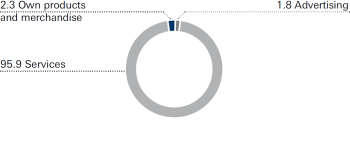

Gruner + Jahr successfully continued its transformation in 2019. Revenues remained organically stable at the previous year’s level, operating EBITDA rose sharply by 12.1 percent to €157 million (previous year: €140 million), and the EBITDA margin improved to 11.6 percent (previous year: 9.7 percent). The reasons for this are share gains in the declining advertising market through the Ad Alliance in Germany, the initial application of IFRS 16 and the growing digital business in Germany and France. Against a backdrop of continued portfolio measures, reported sales declined by 5.9 percent to €1.4 billion (previous year: €1.4 billion). The special-interest publishing house Motor Presse Stuttgart was sold, and the digital marketing platform Ligatus was integrated into Outbrain, the world market leader in native advertising.

In its core countries, G+J once again significantly increased the digital revenue contribution. It now stands at 33 percent (previous year: 27 percent). One growth driver was the AppLike marketing platform, which posted strong increases in both revenues and earnings. Meanwhile, the digital offerings of the magazine brands in Germany and France also saw strong increases in revenues and earnings.

Other reasons for the strong increase in earnings in Germany, besides the merger of Ligatus into Outbrain and the growing digital business, were innovative magazine launches such as “Barbara,” as well as some classic segments like popular science magazines (e.g., “Geo”) and the cheaper production of magazines. This more than compensated for the marketdriven decline in newsstand and print-ad sales.

G+J France’s earnings were well above the previous year. This was due to, among other things, the digital businesses’ earnings performance. DDV Mediengruppe was able to slightly increase its revenues; its result was below the previous year, due to cost factors among other things. Territory, Europe’s leading content communication provider, reported year-on-year declines in revenues and earnings.

As part of the Bertelsmann Content Alliance, G+J took on a leading role in coordinating the collaboration of all Bertelsmann’s content businesses. Initial cross-divisional joint formats such as the MOSAiC Arctic expedition and Crime Day were developed and successfully marketed.

BMG

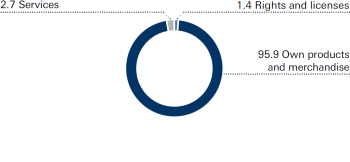

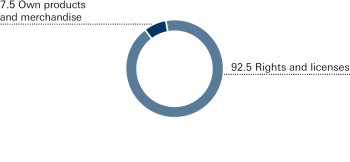

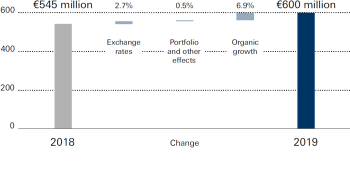

In 2019, Bertelsmann’s music subsidiary BMG continued to record significant increases in revenues and operating profit, driven by organic growth, especially in the recordings business but also in publishing. Revenues increased by 10.1 percent to €600 million (previous year: €545 million), while operating EBITDA rose by 12.7 percent to €138 million (previous year: €122 million). The EBITDA margin therefore increased to 23.0 percent (previous year: 22.5 percent). The share of BMG’s total revenues attributable to digital formats rose to 56 percent in the past financial year (previous year: 52 percent), reflecting continuing growth in the streaming sector.

In the recordings business, BMG outpaced the market’s growth in key territories such as the United Kingdom, where album sales were up nearly 12 percent in a declining market, and the United States, where its music streaming business grew 62 percent, nearly three times as much as the industry as a whole. Successful releases by renowned artists such as Jason Aldean, Blanco Brown, Keith Richards, Dido, The Cranberries, Andy Grammer, AJR and Lil Dicky had a positive effect on the recordings business. Number-one albums included releases from Kylie Minogue, Jack Savorett and Kontra K. BMG signed new record contracts with The Shires, Natalie Imbruglia, Rufus Wainwright, KSI, Huey Lewis & The News, Seeed and Richard Marx, among others. Country star Jason Aldean renewed his contract to be represented worldwide by BMG.

For the first time since the company was re-founded in 2008, BMG launched a new label imprint, Modern Recordings. It is aimed at fans of jazz, new classical and electronic music.

In the publishing business, BMG’s distinctive focus on established artists such as AC/DC, Mick Jagger and Keith Richards of the Rolling Stones, Roger Waters, and Steven Tyler of Aerosmith continued to pay off. In the year under review, they made significant contributions to revenues. Number-one albums included the work of Bring Me The Horizon, Juice WRLD, 21 Savage and Johannes Oerding. Singer-songwriter Lewis Capaldi not only scored a number-one album but also a Grammy-nominated number-one single (“Someone You Loved”). Among the most prominent signings were Neil Finn from Crowded House, Cage The Elephant, KSI, LOCASH and AnnenMayKantereit. Mick Jagger and Keith Richards renewed and expanded their contracts with BMG. Kontra K will also be represented on the publishing side from now on, beyond his existing recordings deal.

BMG continued to expand its production music, film and book businesses, and added artist management to its services portfolio, entering into a partnership with Shelter Music Group. Highlights in the film sector included the documentary “Remember My Name” about David Crosby, which was screened at the Sundance Festival 2019 and later scored a Grammy nomination for Best Music Film.

BMG strengthened its collaboration with Bertelsmann subsidiaries in the areas of TV, audio and film production, books and magazines. The Bertelsmann Content Alliance aims to develop and market media content and formats Group-wide.

BMG opened an office in Hong Kong to strengthen its presence in the Asian market. It also expanded its business in Latin America and Canada, bringing its total number of international offices to 19.

Arvato

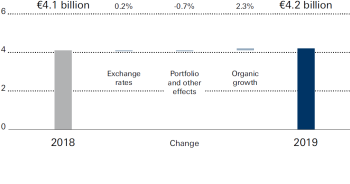

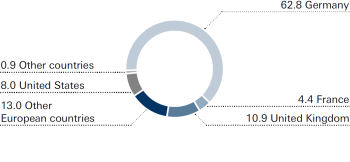

The group’s services activities, pooled in the Arvato division, continued their positive development in 2019. The company’s business operations significantly increased both revenues and operating profit. Revenues grew by 1.8 percent to €4.2 billion (previous year: €4.1 billion), while operating EBITDA increased by 45.7 percent to €549 million (previous year: €377 million). This positive business performance was driven mainly by the strong organic growth of the IT, logistics and financial services businesses and the initial application of IFRS 16. Arvato’s EBITDA margin was 13.2 percent (previous year: 9.2 percent).

In January, Bertelsmann and Morocco’s Saham Group completed the merger of their global CRM businesses. The two partners each own a 50 percent stake in the new company, which will operate globally as Majorel and be fully consolidated at Bertelsmann. Majorel saw a positive business performance last year. The international service center organization grew significantly, especially outside the European Union, with the opening of additional sites in Togo (Lomé), Armenia (Yerevan) and Georgia (Tbilisi and Kutaisi).

The logistics services businesses at Arvato Supply Chain Solutions showed strong and profitable growth in the year under review. It was driven mainly by the establishment of new businesses as well as the expansion of existing ones, particularly with customers in the growth areas of consumer products, healthcare and high-tech. The global network of locations was further expanded by opening new distribution centers and expanding existing ones, including in Germany, Poland and Hong Kong.

Likewise, revenues and operating profit at Arvato Financial Solutions (AFS) developed positively in the reporting period, exceeding the previous year’s results. This development was primarily supported by a steeply positive business trend in the receivables management segment in the GSA region. For example, a comprehensive purchase-to-bill solution was successfully implemented for the customers of a leading international e-commerce marketplace. In the B2B finance area, a new service was developed to make it easier to customize the compilation of regulatory data, validate it and make this data available online.

The IT services provider Arvato Systems grew organically and profitably in the period under review. On one hand, this was due to serialization solutions in the healthcare sector, which were implemented in various European countries. And on the other hand, new customers and contract renewals in the energy, healthcare, retail and media sectors provided positive momentum. In the emerging field of multicloud services, Arvato Systems was able to expand its comprehensive cloud portfolio and further strengthen its position as a service provider through a partnership with Google Cloud Platform (GCP).

Bertelsmann Printing Group

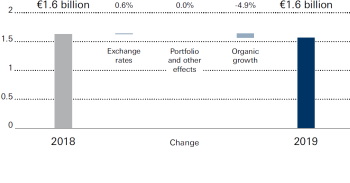

The Bertelsmann Printing Group (BPG), which primarily operates in Europe and the United States, was confronted with a challenging market environment in the past financial year. In the Magazine segment, the decline in circulation continued to intensify across all categories. In the Catalog segment, large-volume projects in particular were under severe cost pressure. Orders in the Brochure segment declined slightly in the 2019 financial year. Overall, group revenues were down 4.3 percent year on year to just under €1.6 billion (previous year: €1.6 billion). Operating EBITDA declined significantly, by 19.6 percent to €68 million (previous year: €85 million). The EBITDA margin was 4.4 percent (previous year: 5.2 percent).

In April 2019, Bertelsmann reorganized the BPG. Since then a new, cross-divisional organizational structure has been implemented in Germany, Switzerland and Austria (BPG GSA), and collaboration between the individual printing companies in the group has been stepped up significantly. In April, it was announced that production capacities in the gravure printing business would be greatly reduced by closing Prinovis’s Nuremberg site in spring 2021.

The printing businesses in BPG GSA recorded a decline in revenue and operating profit in 2019. Europe’s leading offset printing company, Mohn Media, was down year on year, in particular due to lower capacity utilization in the catalog and book business. The gravure operations pooled in the Prinovis Group once again declined in the reporting period, against the backdrop of very difficult market conditions. The group’s directmarketing activities once again increased their revenues and earnings in the past financial year. The multipartner rewards program DeutschlandCard also recorded a very positive performance.

The group’s printing activities in the United Kingdom recorded a slight decline in operating profit. At the Liverpool site, the first offset printing press started operation in spring 2019. Meanwhile, the printing businesses in the United States recorded significant revenue and earnings losses in 2019. The reason for this was massive reductions in circulation by publishing customers and clients in the healthcare sector.

Against the backdrop of a market that continued to slow down significantly, revenues at the storage media manufacturer Sonopress declined, as was expected. The Topac packaging printing company, which is part of the Sonopress Group, successfully entered the market for sustainable food packaging during the past financial year.

Bertelsmann Education Group

The group’s education businesses, which are pooled in the Bertelsmann Education Group, recorded significant growth in the 2019 financial year. Operating profit more than doubled. The division benefited from ongoing high demand for digital educational services in the areas of health, educational theory and technology.

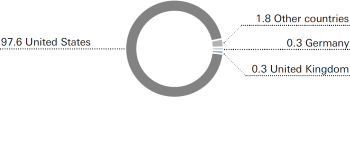

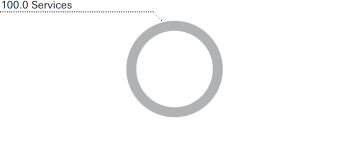

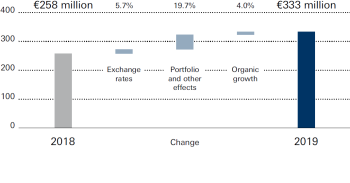

Bertelsmann Education Group revenues increased by 29.4 percent to €333 million (previous year: €258 million). Organic and acquisition-related growth at the e-learning provider Relias, the expansion of the online business at Alliant International University and positive currency effects all contributed to this result. Operating EBITDA improved to €84 million (previous year: €37 million). The EBITDA margin was 25.2 percent (previous year: 14.5 percent).

The e-learning provider Relias, which specializes in online continuing education and training for the healthcare sector, increased its customer base to around 11,200 institutions in 2019. During the course of the year, the healthcare division of the educational provider OnCourse Learning, acquired in 2018, was fully integrated into Relias. The OnCourse divisions for training in financial services and real estate were sold separately.

Alliant International University, specializing in psychology and education, continued to expand its online enrollments. Alliant also introduced a new Student Information System that allows students to plan and manage their academic careers entirely online.

The online learning platform Udacity, in which Bertelsmann holds a significant stake, further developed its range of courses in the technology vertical and introduced new Nanodegrees for data engineering, cloud computing and artificial intelligence. Udacity continued to expand its business with corporate customers.

In 2019, Bertelsmann launched a three-year global education initiative that will provide 50,000 tech scholarships for Udacity courses in the fields of cloud, data and artificial intelligence. Around 46,000 applications from all over the world were submitted for the first round comprising 15,000 scholarships. The courses started in October.

Bertelsmann Investments

In the 2019 financial year, Bertelsmann Investments (BI) expanded its global network of holdings in innovative young companies and extended its regional focus to Africa and Southeast Asia. BI made a total of roughly 80 new and followon investments during the reporting period. At the same time, it completed several exits, so that by year-end the Bertelsmann Investments portfolio comprised around 230 investments.

Bertelsmann Investments once again made a noticeable contribution to the Group’s results, mainly through increases in the value of its holdings and through disposals. EBIT amounted to €107 million (previous year: €96 million).

Bertelsmann Asia Investments (BAI) remains the largest and most active fund in the division, and made 28 new investments, including in the e-commerce platform Tongcheng Life, the online delivery service Ding Dong Fresh and Tomato Mart, an online and offline food retailer. Follow-up investments were made in 13 companies, including Club Factory, a multinational e-commerce platform. With the sale of its stake in the social media platform Bigo Live to the Chinese company YY, BAI also realized the largest exit in the fund’s history in 2019. In addition, BAI sold its holdings in the bike-sharing service provider Hellobike, the social network Momo and other investments.

In July, Afya completed a successful IPO on the NASDAQ in New York. The educational network in the healthcare segment, which was jointly formed by Bertelsmann Brazil Investments (BBI) and its partner Crescera Investimentos, was created by merging NRE Educacional, Medcel and other holdings.

BBI continues to hold an indirect stake in Afya via Crescera’s Bozano Educacional II fund. With around 36,000 students, the company is the largest provider of its kind in Brazil; its portfolio includes various medical education and training programs. BBI also recorded a successful exit from its investment in Jusbrasil.

Bertelsmann India Investments (BII) invested in the agricultural technology start-up Agrostar and in Rupeek, an online platform for loans to private individuals. It also made followup investments in the Fintech company Lendingkart and in Licious, a direct-to-consumer platform for food.

Bertelsmann Digital Media Investments (BDMI) made 20 new investments in 2019, primarily in the United States. BDMI also participated in follow-up investment rounds for 14 fledgling companies, including FloSports, a subscription service for sports media. This was offset by exits from two investments: shares in the food community Food52 and in Crowdtwist, a cloud-based customer loyalty service provider, were sold.

Apart from this, BI participated in several funds in new regions and thematic fields for the first time in 2019. They include Partech Africa and Blossom Capital 1, based in London.

Since 2012, Bertelsmann has invested more than €1 billion in digital companies through its funds; during the same period, returns from the sale of investments have exceeded €600 million.

Combined Non-Financial Statement

The following information relates to Bertelsmann SE & Co. KGaA and the Bertelsmann Group (“Bertelsmann”) with its incorporated, fully consolidated subsidiaries (“subsidiaries”) in accordance with section 315c of the HGB, in conjunction with sections 289b to 289e of the HGB.

Bertelsmann operates in the core business fields of media, services and education in around 50 countries (see the section “Company Profile”). Responsible conduct – toward employees, in society, in business and in dealing with the environment – is firmly anchored in Bertelsmann’s corporate culture. In its corporate responsibility management, Bertelsmann pursues the goal of reconciling commercial interests with social and environmental concerns, within the Group and beyond.

Identifying relevant topics and the concept descriptions in this non-financial statement are oriented toward the standards (2016) of the Global Reporting Initiative (102 and 103). In addition, voluntary reporting based on the GRI Standards (2016; in accordance: “core” option) will be published by the middle of the financial year.

Company Principles and Guidelines

The prerequisites for a corporate culture in which employees, management and shareholders work together successfully, respectfully and in a spirit of trust are common goals and shared values. These are set forth in the corporate constitution as well as in the newly created Bertelsmann Essentials “Creativity and Entrepreneurship,” which were introduced in 2019. Furthermore, the Bertelsmann Code of Conduct – as a binding guideline – defines standards for law-abiding and ethically responsible conduct within the company and toward business partners and the public.

Bertelsmann’s actions are also determined by external guidelines. The company largely follows the recommendations of the German Corporate Governance Code for good andresponsible corporate governance, and the OECD Guidelines for Multinational Enterprises. Bertelsmann is committed to the principles of the Universal Declaration of Human Rights, the United Nations Guiding Principles on Business and Human Rights, and the International Labor Organization core labor standards. A member of the United Nations Global Compact, Bertelsmann supports the Agenda 2030 of the UN.

Corporate Responsibility Management

Organization

The advisory body for the strategic development of corporate responsibility at Bertelsmann is the Corporate Responsibility (CR) Council. The CR Council, which is made up of the Chief Human Resources Officer (CHRO) and representatives from the corporate divisions, focuses on Group-wide CR topics in line with the corporate strategy and the cross-divisional coordination of CR activities within the Group.

At the Group level, the Corporate Responsibility & Diversity Management department coordinates and supports the work of the CR Council in close cooperation with the other Group functions. Within the Bertelsmann corporate structure, the local management teams are responsible for implementing corporate responsibility through specific CR measures and projects. The corporate divisions and companies have their own structures and processes in place for this, in accordance with local requirements.

Topics

To identify key CR topics, Bertelsmann carries out regular CR relevance analyses. For each analysis, the company conducts a survey of internal and external stakeholders; the external stakeholders estimate the impact of Bertelsmann’s business activity on the topics, while the internal stakeholders assess their business relevance. This makes it possible to identify topics of relevance to Bertelsmann relating to environmental, social and employee matters, and respect for human rights, anti-corruption and bribery as well as environmental matters. These topics are analyzed within the company boundaries, unless otherwise stated. The CR relevance analysis of 2018 was confirmed in 2019.

CR topics, including non-financial performance indicators, are not directly relevant to business, and are accordingly not part of Bertelsmann’s value-oriented management system. Due to currently limited measurability, no directly quantifiable statements can be made regarding relevant interdependencies and value increases for the Group. For this reason, the non-financial performance indicators are not used for the management of the Group (see the section ”Value-Oriented Management System”).

Risks

A number of risks associated with CR topics are relevant for Bertelsmann. These risks can arise from the company’s own business activities or from its business relationships, and can affect the company or its environment and stakeholders.

For the non-financial matters defined in the German Commercial Code – social and employee matters, anti-corruption and bribery matters, respect for human rights and environmental matters – no significant risks were identifiable as part of the 2019 reporting. For more information on the relevant risks, please see the section “Risks and Opportunities“.

Employee Matters

Motivated employees ensure long-term quality, innovation and growth. HR work at Bertelsmann is therefore based on the company’s cooperative identity as codified in the corporate constitution and the Bertelsmann Essentials. Supplementary regulations are specified in the Bertelsmann Code of Conduct and the Executive Board guidelines on HR work. The CHRO is primarily responsible for dealing with employee matters within the company. He works closely with the HR managers from the corporate divisions, who report directly to him via a dotted-line concept. The focus of his work includes setting the strategic HR agenda, aligning management development with the Group’s strategic priorities, Group-wide learning, standardizing and providing IT support for important HR processes, developing the corporate culture, and implementing corporate responsibility in the Group. In 2019, measures were taken to address the following topics.

Participation

Bertelsmann sees continual dialogue between employees and company management as a fundamental prerequisite to the company’s success. Although Bertelsmann, as a media company, is free to determine its political direction as defined in the German Works Constitutions Act (Tendenzschutz) and therefore is not subject to statutory co-determination in the Supervisory Board, the company nevertheless makes four positions on the Supervisory Board of Bertelsmann SE & Co. KGaA available to employees on a voluntary basis; three of these are works council members and one is a member of the Bertelsmann Management Representative Committee. In addition, managers, general workforce, employees with disabilities and trainees all have platforms for exchanging ideas, advancing topics and voicing their concerns. For example, the Bertelsmann Group Dialogue Conference is an event where the CEO, CHRO and members of the Corporate Works Council can exchange ideas. In 2019, cross-divisional work groups developed new dialogue formats for employee representatives and management groups, in order to further enhance social partnership. Employees are also involved in the development and improvement of working conditions through standardized HR interview tools (Performance and Development Dialogue, Agreements on Objectives, Team Talk), as well as Group-wide employee surveys. In 2019, for the first time the international employee survey was conducted exclusively online.

Learning

Highly qualified employees are needed to overcome major challenges such as the Group’s increasingly international focus, the digital transformation of media and services, and demographic change. By providing opportunities for lifelong learning, Bertelsmann helps secure the long-term employability of its employees. With four different campuses – Strategy, Leadership, Function and Individual – Bertelsmann University is the central learning organization within the company. The most important measures implemented in 2019 included the further development of international programs in the areas of leadership, strategy and transformation, and – in the context of focusing on our corporate values of creativity and entrepreneurship – formats on the topics of creativity, innovation and entrepreneurship. The three-year Udacity scholarship program, with around 50,000 scholarships, further strengthened the technology focus on the areas of data, cloud and artificial intelligence. In addition, the training and courses offered by Bertelsmann in Germany were continually expanded. New content was included, modern learning environments were created, and teachers were given suitable further qualification.

Diversity

For Bertelsmann, the diversity and differences in its workforce are prerequisites for creativity, innovation and long-term business success. This is conveyed in the Bertelsmann Essentials. The diversity strategy is implemented by the Corporate Responsibility & Diversity Management department, with support from a Group-wide working group. The focus is on the following dimensions: gender, disabilities, sexual orientation and identity, nationality and ethnic origin, as well as generational differences. The Group Management Committee, which at the end of 2019 consisted of 16 members (previous year: 18), included at that time six women (previous year: 6) and six nationalities (previous year: 7). To enhance diversity at the management levels, Bertelsmann aims to achieve the goal of having women occupy one-third of positions in top and senior management across all divisions by the end of 2021. To fulfil this target in top and senior management, the targeted proportion of women in the respective Group-wide talent pools was set at one-third, and was increased to 50 percent in the career development pool. These targets were reached in 2019 for all three talent pools. Furthermore, in 2019 the Bertelsmann Inclusion Action Plan (2019–2024) was rolled out in the German companies.

Health

With a view to designing a health-promoting work environment and preventing work-related risks of disease, Bertelsmann is expanding a systematic health management system at German locations. Bertelsmann Health Management has been put in charge of supervising and coordinating the Germanywide health strategy and associated activities, in conjunction with a cross-functional strategy group. The cross-divisional “Health Community,” which is comprised of health experts, works council chairs, HR managers and representatives for employees with disabilities, plays a key role here. Through targeted networking, it also helps reinforce uniform standards for all German locations. In 2019, advising on health topics was expanded by testing workshop formats and analysis tools in selected Bertelsmann companies.

Fair Working Conditions

At Bertelsmann, remuneration issues are an essential part of the topic of fair working conditions. The policy is to establish consistent and transparent remuneration structures in the Group. The design of the compensation system is intended to ensure that remuneration is driven by market, function and performance, taking into account business-specific characteristics. Employee profit sharing at Bertelsmann and many of its subsidiaries in Germany is based on the same criteria as those used to calculate variable remuneration components for Executive Board members and executives. A number of additional subsidiaries in Germany and abroad have similar success and profit-sharing models adapted to local requirements. In 2019, a total of €116 million of the 2018 profit was distributed as part of such schemes.

Social Matters

Creative Independence

Bertelsmann stands for editorial and journalistic independence, as well as for freedom of the press and artistic license. Bertelsmann publishes a wide variety of opinions and positions. These basic principles for business activities are set forth in the Bertelsmann Code of Conduct. Bertelsmann interprets this independence in two directions. Inside the company, it means that our management does not attempt to influence the decisions of artists, editors and program managers, or to restrict their artistic or editorial freedom. In accordance with the Bertelsmann “Editor-in-Chief Principle,” editorial decisions are the sole responsibility of the content managers. To the outside, this means the company does not capitulate to political or economic influence in its coverage, and complies with existing laws regarding the separation of editorial content and commercial advertising. The result is that the company expects careful research, qualitative reporting and transparency in case of errors. Sound journalism creates a counterweight to fake news and online disinformation. In addition to the Bertelsmann Code of Conduct, many subsidiaries and their editors and creative departments in 2019 continued to implement their own statutes and rules to safeguard editorial and artistic independence in their day-to-day business, and to develop these further where necessary. These statutes focus primarily on duties of care, respect for privacy, and dealing with the representation of violence and the protection of minors.

Content Responsibility

Bertelsmann reflects on the repercussions of the content it produces and distributes, to protect the rights and interests of media users, customers and third parties as far as possible. Overriding principles and guidelines of media ethics are set by national and international laws governing the press, broadcasting and multimedia; by voluntary commitments to external guidelines such as the ethics codes of national press councils; and within the company by the Bertelsmann Code of Conduct and editorial statutes. In accordance with these principles and guidelines, Bertelsmann’s editorial staff are committed to, among other things, “respecting privacy and the responsible treatment of information, opinion and images.” Cross-division verification teams provide their expertise in discerning between authentic and manipulated photos and videos, or those taken out of context. In accordance with the “Editor-in-Chief Principle,” the responsibility for media content lies solely with the content managers in the local editorial teams and creative departments.

In the area of youth media protection, content is monitored at Bertelsmann in accordance with different restrictions for each medium and region to see if it could adversely affect the development of children or young people. In this case, various restrictions come into force, such as broadcasting time restrictions or content and/or product labels. Through voluntary labeling systems, Bertelsmann sometimes goes beyond the existing European and national regulations, particularly in the area of audiovisual media. Other specifications relating to content responsibility are agreed to through supplementary statutes at the divisional, company and editorial level.

Customer Data Protection

Bertelsmann attaches great importance to protecting customer data. This includes safeguarding the personal data of company customers, as well as personal data provided to Bertelsmann by its business partners regarding their customers. The objective of customer data protection is to protect an individual’s right to determine who has what knowledge about the individual, and when. This also means that personal information, or information that could identify a person, must be handled in accordance with legal requirements and adequately protected against unauthorized access. In addition to the Bertelsmann Code of Conduct, customer data protection within the company is regulated by Executive Board guidelines on the topics of information security and IT risk management.

The Executive Board Guideline on Data Protection reflects the basic data-protection legal framework at Bertelsmann Group based on the European Union’s General Data Protection Regulation (GDPR), and is designed to ensure consistent data protection management across the Bertelsmann Group. A Group-wide data protection management system addresses in particular the implementation of the documentation and accountability obligations under GDPR.

Responsibility for customer data protection rests with the management of the individual subsidiaries. To ensure compliance with data protection laws, the subsidiaries in Germany have a data protection organization consisting of central data protection officers and local data protection coordinators. The latter report to the local management, as well as annually or on an event-driven basis to the central data protection officers, who in turn report to the Bertelsmann Executive Board. A similar organization exists in subsidiaries outside Germany. An Information Security Management system (ISMS) based on industry-standard ISO 27001 creates the technical and organizational framework for confidential data processing. The ISMS features a regular and structured survey of relevant processes and procedures, to ensure compliance with statutory information security requirements, a systematic recording of risks and derivation, and control of related mitigation measures.

Protecting Intellectual Property

Bertelsmann’s businesses develop, produce, transfer, license and sell products and services that are protected as intellectual property. For Bertelsmann, the protection of intellectual property rights is the foundation of its business success. For this reason, the company is committed to a high level of global copyright protection worldwide, and fair competition in the digital market. The Group-wide Taskforces Copyright, with representatives from the relevant corporate divisions, monitor current developments in copyright and develop joint positions – for example, on EU copyright law.

Respect for Human Rights

Through its corporate principles and its voluntary commitment to external guidelines, Bertelsmann is committed to respecting and protecting human rights within the company and in its business relationships. For this reason, the Bertelsmann Executive Board established an Integrity & Compliance program and appointed a Corporate Compliance Committee (CCC). The CCC submits an annual Compliance Report to the Bertelsmann Executive Board and the Audit and Finance Committee. The Integrity & Compliance (I&C) department was created to manage the ongoing day-to-day work, and is subordinated to the CCC in the organization. I&C supports the CCC in fulfilling its tasks and makes suggestions for necessary improvements to the I&C program. I&C ensures that employees worldwide are made aware of the key legal provisions and internal company guidelines, including those concerning the respect for human rights, and it implemented the training and communication measures necessary for this in 2019.

Respect for human rights within the supply chain is also expressly stipulated by the Bertelsmann Code of Conduct and the Supplier Code of Conduct. This includes a ban on child and coercive labor and a ban on discrimination and intimidation, and it reaffirms the right to freedom of association and the right to engage in collective bargaining.

In addition, individual subsidiaries and Bertelsmann itself issued statements in 2019 in accordance with the “UK Modern Slavery Act” that condemn all forms of modern slavery, coercive and child labor, and exploitation and discrimination, and present measures to prevent these human rights violations. These statements are revised each year (if required). Infringements of these principles can be reported by Bertelsmann employees and third parties by using the existing compliance management systems.

In terms of anti-discrimination, contact persons for Germany’s “General Equal Treatment Act” (AGG) have been appointed at all German locations. Employees can contact them in the event of suspected breaches of said act. The employees are informed of their rights under the AGG and given corresponding training through a wide range of communication channels. The topic of anti-discrimination was addressed in a Group-wide e-learning program designed to build employee awareness of the issue and advise them of their rights. These and other international activities were continually refined and expanded in 2019.

Anti-Corruption and Bribery Matters

Both the Bertelsmann Code of Conduct and the Bertelsmann Executive Board Guideline on anti-corruption and integrity expressly prohibit all forms of corruption and bribery. This prohibition also applies to all third parties that work for, with or on behalf of Bertelsmann, as stipulated in the Supplier Code of Conduct. Along with instructions for dealing with officials, and guidelines for the granting or accepting of gifts in the context of business relations, the Anti-corruption and Integrity Guideline prescribes appropriate due diligence processes in dealing with third parties. An appropriate due diligence review is carried out for each individual risk profile through a corresponding risk classification. This Executive Board guideline also describes the channels for reporting suspected violations and seeking advice, as well as other prevention and control measures. The Executive Board guideline for dealing with alleged compliance violations anchors an obligation to report suspected violations of the prohibition of corruption to the Bertelsmann Corporate Center. The topic of corruption prevention is globally managed and further developed by the I&C department. One of the most important measures in 2019 was advising and training executives and employees on anti-corruption and the continued Group-wide rollout of the new e-learning program on this topic, conceived in 2017.

Fair Competition and Antitrust Law

Bertelsmann is committed to the principle of fair competition, and condemns antitrust violations and anticompetitive behavior. The company acts against any contravention that becomes known, and consults internal or external experts on antitrust and competition issues. The Bertelsmann Executive Board has approved a “Group Guideline for Compliance with Antitrust Regulations.” There is an obligation to report any antitrust violations. The Corporate Legal Department offers antitrust training programs to corporate divisions and the management and employees of these divisions. A comprehensive compulsory training program for employees working in antitrust-related areas, which was also implemented in 2019, is intended to identify antitrust risks at an early stage and prevent antitrust violations.

Environmental Matters

Bertelsmann aims to become climate-neutral by 2030. This goal was adopted in December 2019 by the Executive Board, and is aligned with a Group-wide guideline adopted in the same year, the Bertelsmann Energy and Climate Policy. The Group-wide environmental efforts include not only the company’s own sites, but also relevant parts of the supply chain – for example, paper suppliers, external printers and energy suppliers. Operational responsibility for energy and environmental management, as well as for implementing measures, rests with the management of the individual companies. The international “be green” working group with representatives from the Bertelsmann corporate divisions again provided a platform for cross-divisional exchange on environmental topics in 2019. The cooperation will focus on increasing the use of paper from certified or recycled sources, and reducing greenhouse gas emissions related to the sites, mobility and products. Experts in the “be green” work group also coordinate an annual environmental survey, conducted Group-wide for the first time on the basis of an IT-based environmental platform.